Effective uses of scenario analysis can up your chances of improving resilience, especially during volatile times in the market. Doing so also provides nuance to your forecasted data, allowing you to improve planning agility, create buffers in your plans and mitigate the impact of changes in the market.

In this case, our focus is on heavy vehicle registrations in the EU and we’re examining the potential effects of increasing operational costs by way of increasing oil prices and freight volume - all of which will invariably impact the registration volume.

The question is where would this land?

To begin with, the figures we arrived at using the univariate models come in at 22.66K (using the Arima model) and 24.32K with the Prophet model selected as the most appropriate model based on the data.

Applying the multivariate models, we anticipate an uptrend with 22.56K heavy vehicle (above 16T) registrations in September, which represents a 24% YoY increase compared to September 2021.

October heavy vehicle registrations peak, displaying a 20.2% YoY increase at 23.68K registrations, and taking it a month further, we forecast 22.97K registrations in November.

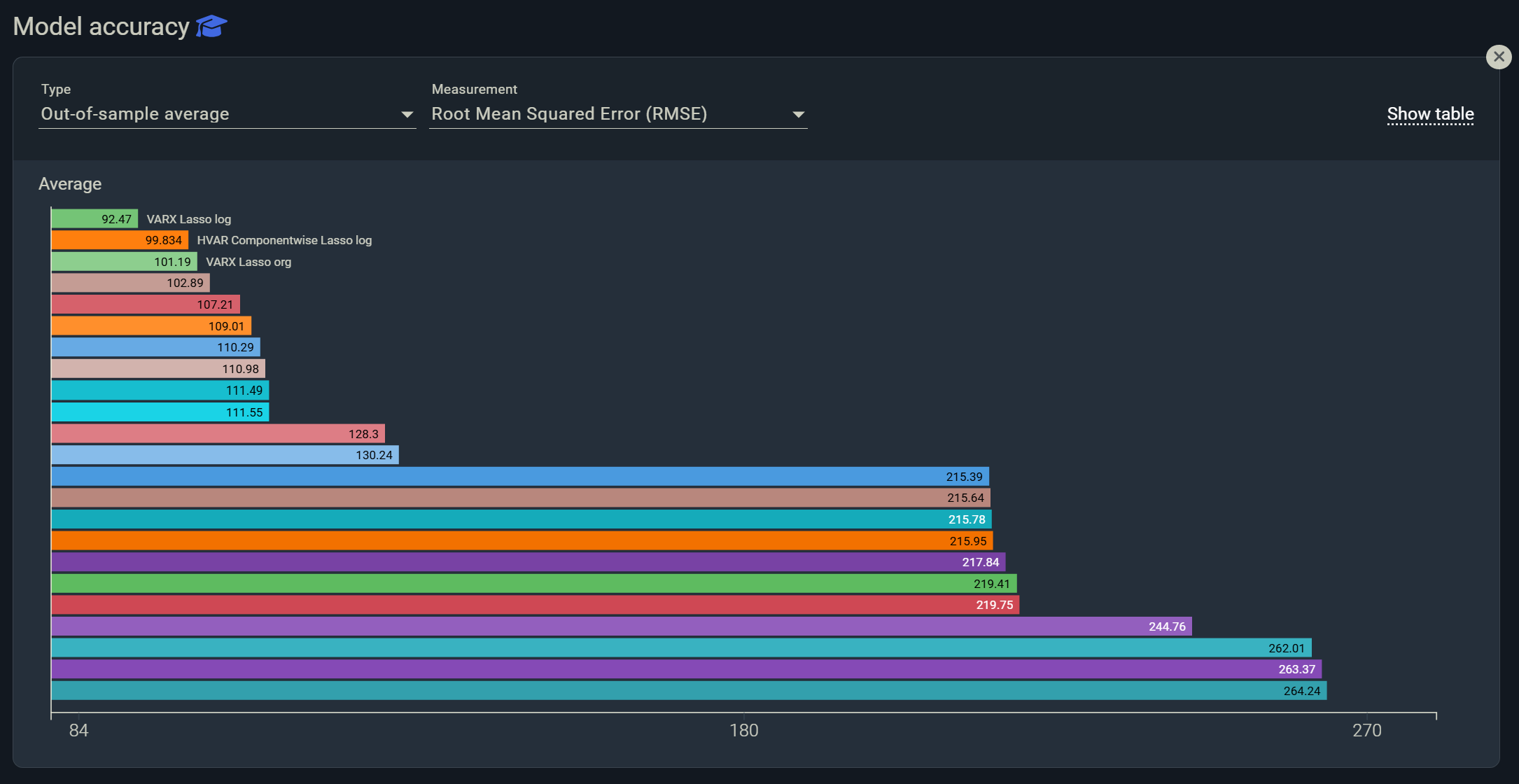

The VAR models with Lasso effects used in Indicio provide us with a clear indication of which variables are meaningful to this forecast. The ones that prove to have the most significance are: China’s Freight traffic, retail trade Confidence Indicator regarding the sale of motor vehicles and ICE Brent Crude.

What happens if China opens up quicker than expected? How would this impact freight traffic?

What if we’re interested in displaying the impact of China opening up quicker than expected, plausibly before the end of 2022? This would impact their growth by 1-2% relative to the current baseline.

By adjusting China’s freight traffic accordingly, we get an immediate preview of its forecasted impact:

.gif)

*It’s good to keep in mind that if you’d like to run a scenario analysis, it’s necessary to have at least 1 valid multivariate model built. In this case, Indicio has built 35 models composed of 13 leading indicators on data from 2003 to 2022.

Would you like to be notified of our next case? Sign up to be on our mailing list:

Playing out an increase in oil prices

In the face of slowing economic growth, the recent decision made by OPEC+ to cut oil production in a bid to stimulate demand, would result in its increasing cost. Let’s make this adjustment under the scenario simulation tool in Indicio - specifically a 10% increase in crude oil prices.

.gif)

In Indicio, we can tweak the variables accordingly and not only get an indication of not only how it would impact the forecasted numbers, but also a clear overview of its relationship with the other variables.

With these two scenarios in play, we posit that the models selected, in particular the VARX Lasso and LSTM models forecast that the heavy vehicles registrations will come in at 24.01K for October.

Let’s take a look at one month ahead.

We pay special attention to the out-of-sample data to validate our findings. This is important to ensure that we are not overfitting our data to any market noise.

*A good guideline is taking a quick look at whether your out-of-sample accuracy error (using RMSE as a measure) is lower than your in-sample data.

This is just one scenario example of what you can test. The beauty with the scenario analysis functionality is having the capacity to optimize plans as often, and to do so in any specific time horizon.

Is there a particular scenario you’d like to simulate? Contact us and let our experts know.